The Blue Water Navy (BWN) Vietnam Veterans Act of 2019 (PL 116-23) extended the presumption of herbicide exposure, such as Agent Orange, to Veterans who served in the offshore waters of the Republic of Vietnam between Jan. 9, 1962 and May 7, 1975.

Beginning Jan. 1, 2020, Veterans who served as far as 12 nautical miles from the shore of Vietnam, or who had service in the Korean Demilitarized Zone, are presumed to have been exposed to herbicides, such as Agent Orange, and may be entitled to service connection for any of the 14 conditions related to herbicide exposure.

VA is also now able to extend benefits to children with spina bifida whose BWN Veteran parent may have been exposed while serving.

Additionally, PL 116-23 made changes to the VA Home Loan Program, specifically:

Veterans with questions about benefits or filing a claim can visit the VA Agent Orange website and Compensation for Surviving Spouse and Dependents (DIC) website. They can also call 1-800-749-8387.

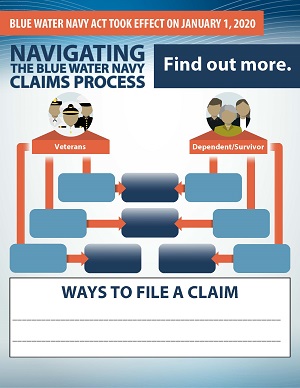

This presentation outlines general information on the Blue Water Navy Vietnam Veterans Act of 2019. It addresses eligibility information and lists the 14 conditions that are subject to presumptive service connection. This briefing provides different example scenarios of how Veterans, their families, survivors, and dependents might be affected. It also answers several frequently asked questions, including how to file a claim.

The process and form needed to file a BWN claim depends on you or your family member’s individual circumstance and past claim experience. Select an option below to find out more and get in touch with someone who can help.

As listed above, the Blue Water Navy Vietnam Veterans Act of 2019 affected the VA Home Loan Program in several ways. These new changes may affect you as a borrower.

Below are examples of how Veterans, their families, and dependents could be affected.

Rocco, a U.S. Navy Veteran who served aboard the USS Dynamic in 1968, has a legacy appeal pending since December 2018 for service connection for diabetes mellitus type II. A Statement of the Case has not yet been issued.

What does he need to do currently?

Nothing. After January 1, 2020, VA will be automatically reviewing claims that are currently with the VA review process or under appeal.

Joan is the widow of a Navy Veteran who, in 1970, served on the USS St. Louis in the offshore waters of the Republic of Vietnam, who never went ashore, and who died of chronic b-cell leukemia in 2009.

Can she file for DIC as the survivor of a Veteran whose death resulted from a service-related condition?

Yes, she can, even if she filed an application which was previously denied. She may be eligible to receive tax-free monetary benefits, although if she is not a Veteran herself, she will not be eligible to receive VA healthcare.

Use VA Form 20-0995 (if she previously applied) otherwise use VA Form 21P-534EZ.

Tim, a U.S. Army National Guard Veteran who separated from service honorably in 2015, recently married and is now seeking to purchase his first home with the help of a VA home loan guaranty. He has never received disability compensation benefits.

Will he be required to pay the increased funding fee mandated in Public Law 116-23?

No, he would pay a lower funding fee. Also, he will have a no down payment option, no matter what the cost of the home he intends to purchase.

For a $350,000 home in Omaha, NE, with no downpayment he will pay:

Prior to Jan. 1 - $8,400 funding fee

After Jan. 1 - $8,100 funding fee